Navigating the Stock Market Rollercoaster: Tips for Investors

What is Market Volatility?

Market volatility refers to the degree of variation in the price of a financizl asset over time. It is a crucial concept for investors to understand, as it indicates the level of peril associated with an investment. High volatility means prices can change rapidly in a short period, which can lead to significant gains or losses. This can be thrilling. Conversely, low volatility suggests a more stable investment environment.

Factors contributing to market volatility include economic indicators, geopolitical events, and changes in investor sentiment. For instance, unexpected news can trigger rapid price movements. This is often alarming. Understanding these factors helps investors make informed decisions. Knowledge is power.

Investors can measure volatility using various tools, such as the VIX index, which reflects market expectations of future volatility. This index is often called the “fear gauge.” It provides insights into market sentiment. Awareness is key. By recognizing the signs of volatility, investors can better navigate the stock market’s ups and downs. Stay informed.

Historical Trends in Market Fluctuations

Historical trends in market fluctuations reveal patterns that can inform investment strategies. For instance, he may observe that markets often react sharply to economic downturns. This reaction can be predictable. Additionally, bull markets typically follow bear markets, indicating cyclical behavior. Understanding these cycles is essential.

Moreover, significant events, such as financial crises or geopolitical tensions, have historically triggered volatility. He should consider these influences. Such events often lead to panic selling or buying frenzies. This can create opportunities. By analyzing past trends, he can better anticipate future movements. Knowledge is crucial.

The Impact of Economic Indicators

Economic indicators significantly influence market behavior and investor sentiment. For example, metrics such as GDP growth, unemployment rates, and inflation provide insights into economic health. These indicators can signal potential market movements. A rjsing GDP often correlates with increased investor confidence. This is a key factor.

Conversely, high unemployment rates may lead to market pessimism. Investors often react swiftly to such data. Additionally, inflation can erode purchasing power, impacting consumer spending. This can create volatility. By closely monitoring these indicators, investors can make informed decisions. Awareness is essential.

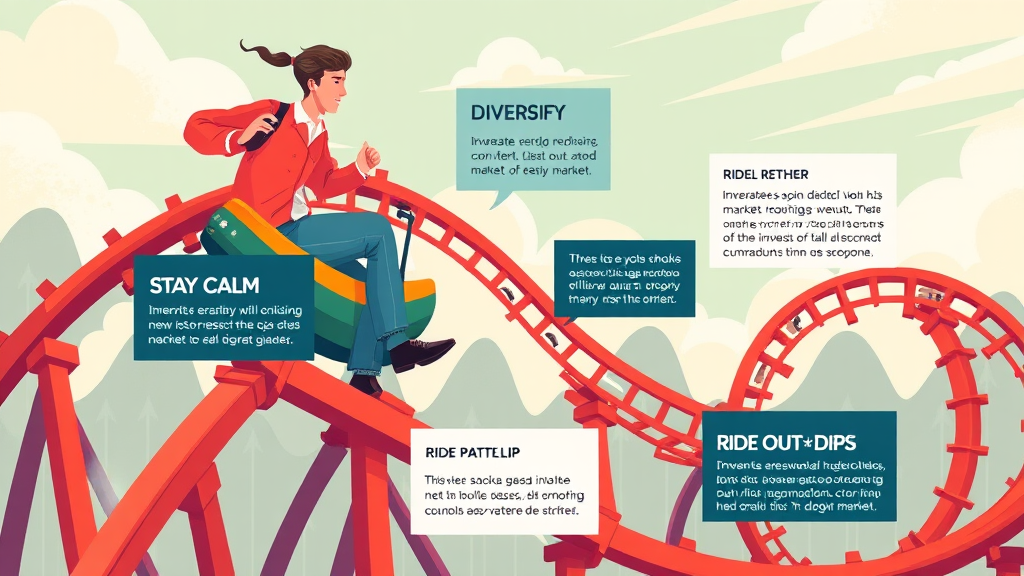

Investment Strategies for Uncertain Times

Diversification: Spreading Your Risk

Diversification is a fundamental strategy for managing investment risk. By allocating capital across various asset classes, investors can mitigate potential losses. This approach reduces exposure to any single investment’s volatility. It is a prudent choice.

For instance, combining stocks, bonds, and real estate can create a balanced portfolio. Each asset class reacts differently to market conditions. This can enhance overall stability. Additionally, geographic diversification can further spread risk. Investing in international markets can provide additional opportunities.

Investors should regularly review their portfolios to ensure proper diversification. This is essential for long-term success. A well-diversified portfolio can withstand market fluctuations more effectively.

Long-Term vs. Short-Term Investing

Long-term investing focuses on building wealth over time through the appreciation of assets. He typically benefits from compounding returns. This strategy often involves less frequent trading, which can reduce transaction costs. It is a wise approach.

In contrast, short-term investing aims for quick profits by capitalizing on market fluctuations. He may engage in frequent buying and selling. This method can be riskier due to market volatility. Quick gains can be enticing.

Ultimately, the choice between these strategies depends on his financial goals and risk tolerance. Understanding both approaches is crucial. Each has its advantages and challenges. Knowledge is essential for success.

Utilizing Stop-Loss Orders

Utilizing stop-loss orders is a strategic approach to risk management in investing. He can set a predetermined price at which his assets will automatically sell. This mechanism helps limit potential losses during market downturns. It is a protective measure.

For instance, if he purchases a stock at (50, he might set a stop-loss order at )45. This ensures that if the stock price falls, it will sell automatically, preventing further losses. This can provide peace of mind.

Moreover, stop-loss orders can be adjusted as market conditions change. He should regularly review these levels. This flexibility allows him to adapt to volatility. Awareness is key in uncertain times.

Emotional Resilience in Investing

The Psychology of Fear and Greed

The psychology of fear and greed significantly influences investment decisions. He often experiences fear during market downturns, leading to panic selling. This reaction can result in missed opportunities. It is a common mistake.

Conversely, greed can drive him to take excessive risks during market upswings. This behavior may lead to overexposure in volatile assets. Awareness of these emotions is crucial. By recognizing these psychological triggers, he can develop emotional resilience.

Implementing strategies such as setting clear investment goals can help mitigate emotional responses. He should remain disciplined in his approach. This can foster a more rational decision-making process. Knowledge is empowering.

Staying Disciplined During Market Swings

Staying disciplined during market swings is essential for successful investing. He must adhere to his investment strategy, regardless of market volatility. Emotional reactions can lead to impulsive decisions. This can be detrimental.

Establishing predefined entry and exit points can help maintain focus. He should avoid making decisions based solely on market noise. This requires a strong commitment to his plan. Consistency is vital.

Additionally, regular portfolio reviews can reinforce discipline. He can assess performance against his goals. This practice fosters a rational mindset. Awareness is crucial for long-term success.

Mindfulness Techniques for Investors

Mindfulness techniques can enhance emotional resilience for investors. By practicing mindfulness, he can cultivate awareness of his thoughts and feelings. This helps in managing focus during market fluctuations. It is a valuable skill.

For instance, he might engage in deep-breathing exercises before making investment decisions. This can promote clarity and focus. Additionally, maintaining a daily meditation practice can improve emotional regulation. Consistency is key.

Journaling his thoughts about market movements can also provide insights. He can reflect on his emotional responses to different situations. This fosters self-awareness. Understanding emotions is essential for effective investing.

Leveraging Technology and Tools

Using Trading Platforms Effectively

Using trading platforms effectively requires understanding their featyres and tools. He should familiarize himself with charting software to analyze market trends. This can enhance decision-making. Additionally, utilizing real-time data feeds can provide a competitive edge. Timeliness is crucial.

He can also set up alerts for price movements or news events. This helps him stay informed without constant monitoring. Furthermore, leveraging backtesting tools allows him to evaluate strategies based on historical data. This is a smart approach.

By integrating these tools into his trading routine, he can optimize performance.

Analyzing Market Data with AI

Analyzing market data with AI can significantly enhance investment strategies. He can utilize machine learning algorithms to identify patterns in historical data. This approach improves predictive accuracy. Additionally, AI can process vast amounts of information quickly. Speed is an advantage.

By employing sentiment analysis, he can gauge market sentiment from news articles and social media. This provides valuable insights into investor behavior. Furthermore, AI-driven tools can optimize portfolio management by suggesting asset allocations. This is a smart strategy.

Incorporating AI into his analysis can lead to more informed decisions. Knowledge is power in investing.

Staying Informed with News Aggregators

Here are 10 trending article titles for a financial website based on the latest news and analysis of financial trends: No input data

Learning from Past Market Crashes

Case Studies of Major Market Crashes

Case studies of major market crashes provide valuable insights for investors. For example, the 1929 stock market crash was triggered by excessive speculation and over-leveraging. This led to a significant loss of investor confidence. It was a devastating event.

Similarly, the 2008 financial crisis stemmed from the collapse of the housing bubble. Poor lending practices contributed to widespread defaults. This resulted in a global recession. Understanding these factors is crucial.

By analyzing these events, investors can identify warning signs. He should remain vigilant during periods of rapid market growth. Awareness is essential for informed decision-making.

Lessons Learned from Historical Events

Lessons learned from historical events are crucial for investors. For instance, the dot-com bubble of the late 1990s highlighted the dangers of speculative investing. Many investors lost significant capital. It was a harsh reality.

Additionally, the 2008 financial crisis emphasized the importance of due diligence. Poor risk assessment led to widespread financial instability. Understanding these lessons can prevent future mistakes.

Investors should prioritize diversification to mitigate risks. This strategy can protect against market volatility. Knowledge is essential for informed decisions.

Preparing for Future Market Downturns

Preparing for future market downturns involves strategic planning and risk management. He should maintain a diversified portfolio to reduce exposure to any single asset class. This can help mitigate losses during downturns. It is a prudent approach.

Additionally, he can establish an emergency fund to cover unexpected expenses. This provides financial security in turbulent times. Regularly reviewing and adjusting his investment strategy is also essential. Flexibility is important.

Moreover, staying informed about economic indicators can help him anticipate market shifts. By learning from past market crashes, he can make more informed decisions.

Integrating Cryptocurrency into Your Portfolio

Understanding the Role of Crypto in Diversification

Understanding the role of cryptocurrency in diversification is essential for modern investors. He can incorporate crypto assets to enhance portfolio resilience. This can reduce overall risk exposure. It is a strategic move.

Cryptocurrencies often exhibit low correlation with traditional assets like stocks and bonds. This characteristic can provide a hedge during market volatility. He should consider allocating a small percentage of his portfolio to crypto. This is a common practice.

Additionally, he must conduct thorough research on various cryptocurrencies. Each has unique risk profiles and potency returns. Knowledge is crucial for informed decisions. By integrating crypto wisely, he can achieve better diversification.

Evaluating Risk vs. Reward in Crypto Investments

Evaluating risk versus reward in crypto investments is crucial for informed decision-making. He must assess the volatility associated with cryptocurrencies, as they can experience significant price fluctuations. This can lead to substantial gains or losses. It is a high-stakes environment.

Moreover, understanding the underlying technology and market dynamics is essential. Each cryptocurrency has unique features that influence its risk profile. He should consider factors such as market capitalization and liquidity. These are important metrics.

Additionally, diversifying within the crypto space can help mitigate risks. He can invest in a mix of established coins and emerging tokens. This strategy can balance potential rewards with acceptable risk levels. Knowledge is key in navigating this landscape.

Future Trends in Cryptocurrency and Traditional Markets

Future trends in cryptocurrency and traditional markets indicate a growing convergence. As institutional adoption increases, cryptocurrencies may gain legitimacy. This can enhance their role in diversified portfolios. It is a significant shift.

Moreover, advancements in blockchain tecunology are likely to improve transaction efficiency. He should consider how these innovations impact market dynamics. Additionally, regulatory developments will shape the landscape.

Investors may also see the rise of hybrid financial products that combine crypto and traditional assets. This can provide new opportunities for diversification. Knowledge is crucial for navigating these changes.